Author: David Binney

What happened?

Since the beginning of the year, the world’s major stock indices are down, and the United States indices in particular have suffered losses. From their early January highs, the All Country World index and the S&P 500 had fallen ~10%, while the Nasdaq composite had fallen ~15%, before each recovered slightly on January 28, 2022.

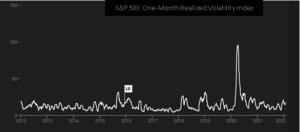

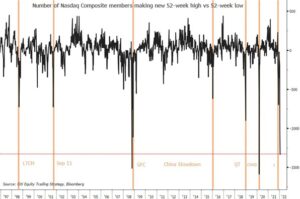

Although the downward moves are not severe within the context of normal stock market volatility, they appear so for two reasons. First, 2021 was particularly calm following the turbulent market events of 2020. As shown on Chart 1 below, the S&P 500 rose or fell more than 2% only seven times in 2021 versus 44 times in 2020. Moreover, Chart 2 shows that while realized volatility in 2021 was slightly below the 10-year average, it was significantly below the market volatility experienced in 2020. More broadly, the stock market tends to fall 10% every 1.5 to 2 years, so these recent moves only are unusual when comparing the stock market to particularly calm times. Second, underneath the headline indices, there is a notable rotation happening and pockets of truly astonishing capital destruction. For an example of a rotation, the S&P 500 Energy index has gained ~18% YTD while the S&P 500 Consumer Discretionary index has lost ~13% YTD, compared to the last five years when energy stocks generated annualized losses of 2% and consumer discretionary stocks generated positive annualized returns of 16%. For examples of capital destruction, there are many, including meme stocks, SPACS, recent IPOs, retail favorites being cut in half, or worse. On the Nasdaq composite, the number of companies making 52-week lows versus 52-week highs currently has only been exceeded in March 2020 and late 2008 over the last 25 years. See Chart 3 from Citi.

Chart 1

Chart 2

Chart 3

Why Has This Happened?

It is always hard to pinpoint the cause of market moves, and there frequently is no one single cause. Nonetheless, our succinct perspective is that the market’s risk appetite has changed. There is little chance that the earning or cashflow prospects of many of the individual stocks have dropped 50-80% in the past few weeks. (One also can query whether their prospects had gone up 5-10x from mid-2020 to late 2021 in the first place). However, the market’s perception of the adequate compensation for investing in certain high-risk stocks or similar exposures has changed markedly.

The longer perspective is that we have had a confluence of economic changes which has made the market less certain as to the economy’s future path. This fundamental change has rather suddenly made certain stocks less attractive. Exacerbating this move has been a myriad of technical adjustments, such as overall liquidity in the market, computer-driven algorithmic trading which often amplifies market moves, so-called “black-out” windows (where companies cannot repurchase their own stock), less stock interest by retail investors, and big banks’ positioning changing as a result of different option purchase patterns (i.e. when many people buy call options, banks then buy the underlying stock to hedge; when many people buy puts, banks then sell the underlying stock to hedge).

In our view, the fundamental economic change has been driven by: a) the Federal Reserve (and other central banks) becoming more hawkish; and b) a medium-term view of potential underlying economic weakness, in part driven by the lower chances of additional fiscal stimulus. Between the two changes, we think the former is largely driving markets and has led to the repricing of risk.

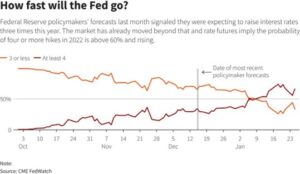

As you can see in Charts 4 and 5, the Fed has become increasingly hawkish as inflation has not abated (so less chance it is merely “transitory”) and employment is close to full. As the Fed gauges its dual mandate of maximum employment and price stability, it now is focusing more on price stability, in part because rampant runaway inflation can lead to skewed economic decisions and a knock-on, lowering effect on unemployment. As you can see, the Fed has “talked the market” from roughly two interest rate hikes in 2022 as of early October 2021 to 6 expected hikes during 2022 as of last week. Six hikes would be more than all of the hikes the Fed did from 2013 (the infamous taper tantrum) to late 2017.

Chart 4

Chart 5

In addition to the Fed signaling many more hikes than the market had anticipated a few weeks ago, the Fed has been accelerating its projected pace of so-called balance sheet normalization. When you put all of these changes in context, the market seemingly no longer believes that there is a near-term “Fed Put”,1 whereby the Fed may pause on rate hikes or balance sheet normalization if the stock market swoons. Some believe the Fed Put is now at lower levels than previously thought. Some even believe that there is a Fed “sold-call” dynamic, whereby if the stock market does not adjust and help cool the economy through wealth effects, the Fed is more likely to keep raising rates, ceteris paribus (i.e., for a given level of inflation). Critically, every other recent time the Fed Put has been relevant, the Fed had more options as inflation was near or below 2%. Today is very different with inflation running 300-400bps above the Fed’s comfort level. These perceived changes and the pace of the change has caused, in our view, a lot of the market machinations we have observed over the past few weeks and months. Where the Fed relents is hard to predict. Clearly, the Fed is reacting to evolving inflationary pressures. We believe that the Fed will continue to modulate its rhetoric and actions to ensure that inflation does not become entrenched at anywhere near current levels.

What Are We Doing About This?

In short, we are doing three things: (1) we are maintaining our slight overweight to equities, (2) we are staying underweight to fixed income, and (3) we are watching our underlying managers to see if they are taking advantage of the rotation and violent trading patterns.

We are maintaining our allocation to equities because we think the odds are on our side. (Here, we will speak mostly of the United States as it is the largest position and most impactful to our clients.) It strikes us that of the three most relevant factors effecting equities, two on our side. The first is the basic construct of equities. They represent a share on the earnings of companies. We perceive that people are working hard, innovation and productivity are happening, and there is nothing fundamentally different regarding equities and that claim to company earnings than during the prior 100 years.

The second factor is our view of the economy. While we believe the economy is unlikely to repeat its epic recovery in 2021, it is unlikely to flip into recession. There is a halting reopening still going on, there is pent up

demand for various services, consumers have substantial savings (compared to pre pandemic), the Fed is still accommodative (despite the changes discussed above), and the federal government is still running deficit spending. For these reasons and numerous others, we think it is unlikely the United States flips into recession. The market seems to agree with our evaluation as there is little indication of distress in other recession sensitive asset classes, such as credit (spreads have not widened), and the Yen (has not rallied strongly). Of course, there is no guarantee that we will avoid a recession, but recessions themselves are rare, and the odds seem slightly lower now than on average due the factors noted above. Critically, when we are not in recession, the stock market usually delivers positive returns. In fact, the stock market does so more than 80% of the time. To go against these odds, one must be very confident this time is different.

We acknowledge that the third element, the Fed’s posture, is against us. No longer can the Fed be counted on to “prime the pump.” The old saw of “don’t fight the Fed” comes to mind. However, we believe the market now has digested a more hawkish Fed, and that inflation will moderate over 2022 as: (i) comparisons drop out, (ii) some supply bottlenecks ease, and (iii) labor shortages abate as (hopefully) omicron wanes. As long as the Fed stays roughly where it is now, with an expected Fed funds at ~1% – 1.5% in 2022 and ~2% in 2023, we think the economy and market can handle these increases. We do concede that the Fed could become yet more hawkish if inflation persists (as could well happen due to oil supply reductions, other goods supply constraints, or China’s zero COVID policy leading to further shutdowns). As we gauge the three critical elements, and the odds of staying invested, we continue to believe maintaining full equity exposure is prudent. This view in no way precludes additional bouts of volatility and of course the potential for even more steep drops. Sometimes sentiment becomes self-fulfilling. Based on our read of the market, we do not think this is one of those cases. But nothing is assured.

Our second view is to remain short fixed income. We have held this view and have provided our thinking around it a number of times. In short, we understand that rates can be driven lower by economic weakness, investor fear and non-economic actors (such as central banks) deciding to drive them lower. However, one of the main actors, the Fed, has just told us they will no longer be driving rates quite so low. We expect yields to trend higher at a measured pace. We do not expect the longer end of the curve to increase rapidly, but given a choice between it falling precipitously lower or jumping precipitously higher, we would choose the latter. As the Fed has indicated where they intend to drive rates, and we believe there is asymmetry in rate increases versus rate reductions, we have maintained slightly less than full fixed income exposure and less duration in the fixed income we do hold.

Finally, we note that our managers are finding interesting opportunities. There are big chunks of the markets that are down far more than 10% over the past few months. We and our manager partners believe there has been material indiscriminate selling, which is to be expected in a market that has become dominated by passive capital and ETFs. One of our largest managers tracks the required return to reach “intrinsic value” in their portfolio. It is currently at 95%, a level that it has reached less than 2% of days since their inception. Despite a modest value bias, this group has outperformed in eight out of the last nine years. We are inclined to trust their judgment about the individual companies that they own. Managers are finding opportunities in a variety of areas including payments, biotech, small/mid cap, and pieces of the energy/materials/industrials complex that are likely to benefit from decarbonization. For some but not all of these areas, inflation in the economy may actually prove a modest benefit.

Overall, we expect that the markets will continue to have bouts of volatility more consistent with historical patterns. Volatility may be even higher as the market digests a more hawkish Fed, for only the second time in the last 14 years. For now, we are maintaining our positioning as slightly overweight equities and shorter fixed income. We will continue to monitor the economy and our managers to gauge whether we should change our view, paying careful attention in particular to central banks actions and rhetoric, and the inflation dynamics. We appreciate the opportunity to manage your capital through this interesting time.

1 There are valid reasons to believe that the Fed should observe the stock market, not as its primary objective, but in so far as through the “wealth effect”, consumers and CEOs are more likely to spend and take risks when they feel wealthy than when they feel less well off. Whether the Fed Put is valid, good public policy, a skewing of capitalism, leads to excess risk-taking, or beneficial to income equality is beyond the scope of this note.

Past performance is no guarantee of future results and the opinions presented cannot be viewed as an indicator of future performance.

There is no guarantee that any particular asset allocation or mix of strategies will meet your investment objectives.

These materials are being provided for informational purposes only and constitute neither an offer to sell nor a solicitation of an offer to buy securities. Opinions expressed herein are those of TIFF and are not a recommendation to buy or sell any securities.

These materials may contain forward-looking statements relating to future events. In some cases, you can identify forward- looking statements by terminology such as “may,” “will,” “should,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” the negative of such terms or other comparable terminology. Although TIFF believes the expectations reflected in the forward-looking statements are reasonable, future results cannot be guaranteed.